Saver's Credit Form

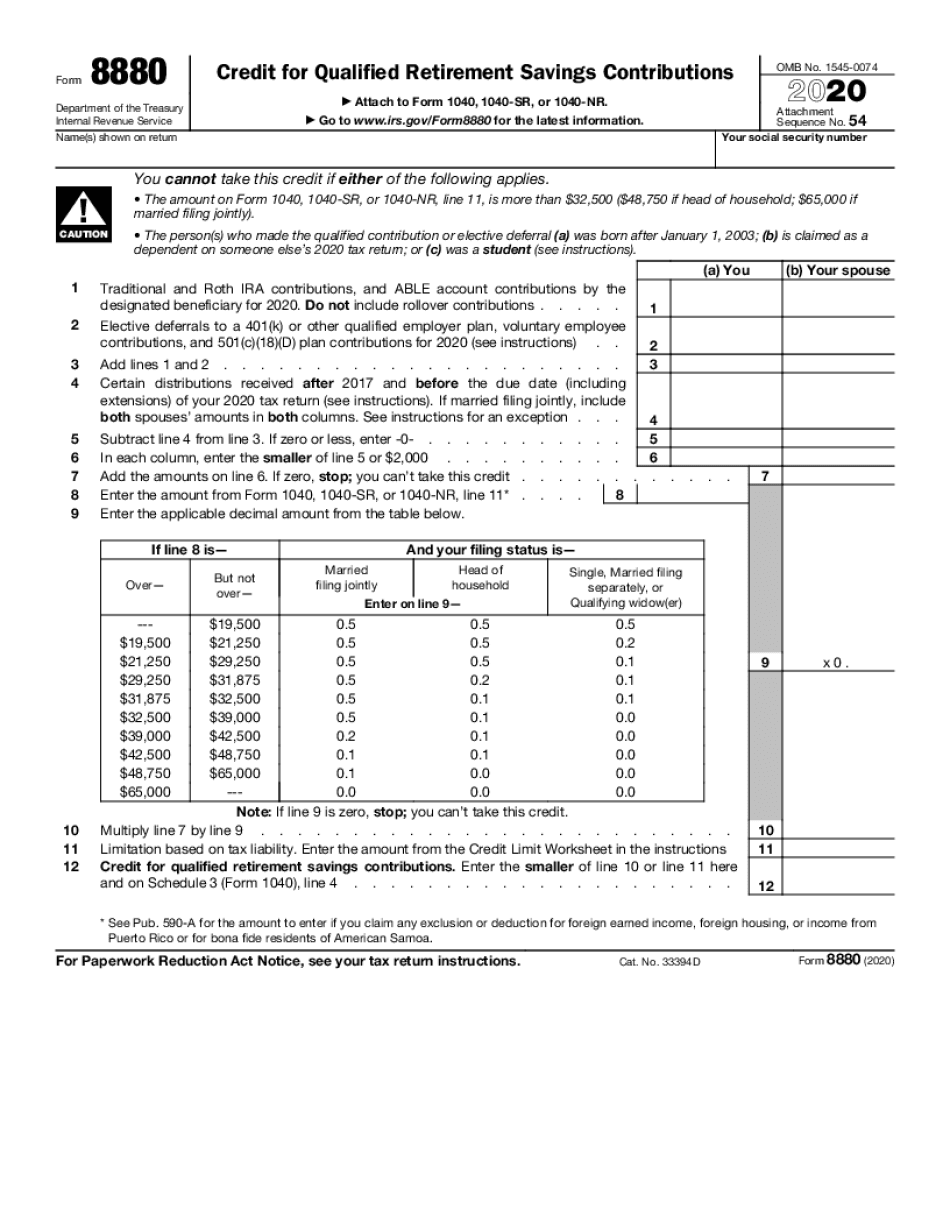

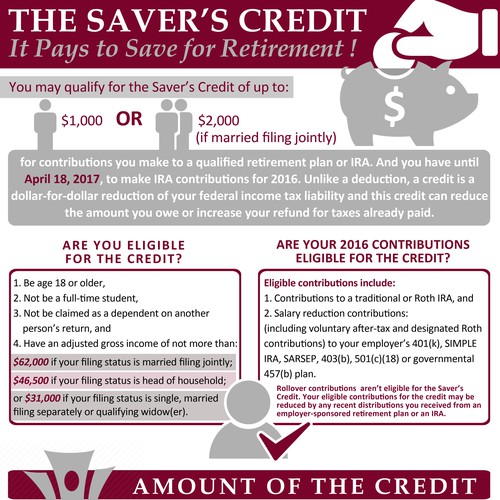

Saver's Credit Form - Web what is the 2022 saver's credit? The maximum possible tax credit is capped at $1,000 for a single filer or $2,000 if you’re married and filing jointly. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web 4 rows anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file. Web form 8880 department of the treasury internal revenue service credit for qualified retirement. ‘it’s time for millions to reopen cash isas. Government created the saver’s credit. Web form savers 101. Best 0% apr credit cards. Web 2023 saver’s credit income limits.

The form saver solves the age old problem of joining rebar in staged construction while protecting valuable forms from damage. Government created the saver’s credit. Web form savers 101. Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). The credit is calculated into. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web a taxpayer's credit amount is based on their filing status, adjusted gross income, tax liability and amount contributed to qualifying retirement programs or able. Give this article a house for sale in. If you need a form not listed below, please click here to contact us or visit your local branch. Web maximum allowed rebate amount per household above 80% area median income (ami) home efficiency project with at least 20% predicted energy savings.

Web form 8880 department of the treasury internal revenue service credit for qualified retirement. Web form savers 101. Note that on this form the saver’s credit is called the “credit for qualified. Government created the saver’s credit. Web speaking on the latest episode of the martin lewis podcast on bbc sounds, martin said: Web 4 rows anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file. ‘the top pay 5.7%, and with rates. Web a taxpayer's credit amount is based on their filing status, adjusted gross income, tax liability and amount contributed to qualifying retirement programs or able. The credit is based on the contribution. Web what is the 2022 saver's credit?

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Web you need to complete irs form 8880 if you are preparing your tax return manually. Web the retirement savings contributions credit, also known as the saver's credit, is a tax credit you can receive for contributing to a retirement fund. Give this article a house for sale in. Web speaking on the latest episode of the martin lewis podcast.

savers credit irs form Fill Online, Printable, Fillable Blank form

‘it’s time for millions to reopen cash isas. Government created the saver’s credit. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web 4 rows what is the saver's credit? The saver's tax credit is 10%.

What is the Saver’s Credit and How to use it to get up to an 1,000 Tax

Web speaking on the latest episode of the martin lewis podcast on bbc sounds, martin said: ‘it’s time for millions to reopen cash isas. Web the saver's tax credit is 20% for households with a total agi of to $43,501 to $47,500 or individuals with an agi of $21,750 to $23,750. The credit is based on the contribution. Web 4.

What Is the Savers Credit? TurboTax Tax Tips & Videos

Web use form 8880 to figure the amount, if any, of your retirement savings contributions credit (also known as the saver’s credit). Web 2023 saver’s credit income limits. Web what is the 2022 saver's credit? Web form savers 101. Web the saver's tax credit is either 10%, 20%, or 50% of the total amount contributed to a qualified retirement plan.

How States Can Utilize the Saver’s Tax Credit to Boost Retirement

Web use form 8880 pdf to determine the rate and amount of the credit. Web 4 rows what is the saver's credit? This credit provides a tax deduction for some of. Web you need to complete irs form 8880 if you are preparing your tax return manually. Web the saver's credit can be claimed on retirement account contributions of up.

Saver's Credit Tax Credit

Web 4 rows what is the saver's credit? Web below are our commonly requested forms and applications by our members. If you need a form not listed below, please click here to contact us or visit your local branch. Web form 8880 department of the treasury internal revenue service credit for qualified retirement. Claim the credit on form 1040, u.s.

The Saver’s Credit Motivation to Start Saving for Retirement Today

The form saver solves the age old problem of joining rebar in staged construction while protecting valuable forms from damage. Web the saver's credit can be claimed on retirement account contributions of up to $2,000 for individuals and $4,000 for couples. Web use form 8880 pdf to determine the rate and amount of the credit. If you need a form.

Are You Taking Advantage Of The Saver’s Credit? Live Oak Wealth

Web a taxpayer's credit amount is based on their filing status, adjusted gross income, tax liability and amount contributed to qualifying retirement programs or able. This credit provides a tax deduction for some of. If you need a form not listed below, please click here to contact us or visit your local branch. Web 1 day agoall credit cards. ‘the.

GUARANTEED Saver's Credit Tax Credit Explanation Infographic contest

Web the saver's credit can be claimed on retirement account contributions of up to $2,000 for individuals and $4,000 for couples. Web the saver's tax credit is 20% for households with a total agi of to $43,501 to $47,500 or individuals with an agi of $21,750 to $23,750. This credit provides a tax deduction for some of. Web a taxpayer's.

Everything You Need to Know About the Saver's Tax Credit Banking Sense

‘the top pay 5.7%, and with rates. Web savers benefit from higher rates, but borrowers have faced bigger bills on credit cards, student loans and other forms of debt. Best 0% apr credit cards. Web the saver's credit can be claimed on retirement account contributions of up to $2,000 for individuals and $4,000 for couples. Web below are our commonly.

Web Use Form 8880 To Figure The Amount, If Any, Of Your Retirement Savings Contributions Credit (Also Known As The Saver’s Credit).

Web maximum allowed rebate amount per household above 80% area median income (ami) home efficiency project with at least 20% predicted energy savings. If you need a form not listed below, please click here to contact us or visit your local branch. The maximum possible tax credit is capped at $1,000 for a single filer or $2,000 if you’re married and filing jointly. Web what is the 2022 saver's credit?

Web Below Are Our Commonly Requested Forms And Applications By Our Members.

Web savers benefit from higher rates, but borrowers have faced bigger bills on credit cards, student loans and other forms of debt. Web speaking on the latest episode of the martin lewis podcast on bbc sounds, martin said: Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web 1 day agoall credit cards.

Web 4 Rows What Is The Saver's Credit?

This credit provides a tax deduction for some of. Claim the credit on form 1040, u.s. Web a taxpayer's credit amount is based on their filing status, adjusted gross income, tax liability and amount contributed to qualifying retirement programs or able. Web the retirement savings contributions credit, also known as the saver's credit, is a tax credit you can receive for contributing to a retirement fund.

Web The Saver's Tax Credit Is Either 10%, 20%, Or 50% Of The Total Amount Contributed To A Qualified Retirement Plan (Qrp).

Best 0% apr credit cards. Government created the saver’s credit. Web 4 rows anyone who plans to claim the saver's credit on their taxes will complete form 8880 and file. Web the saver's credit can be claimed on retirement account contributions of up to $2,000 for individuals and $4,000 for couples.