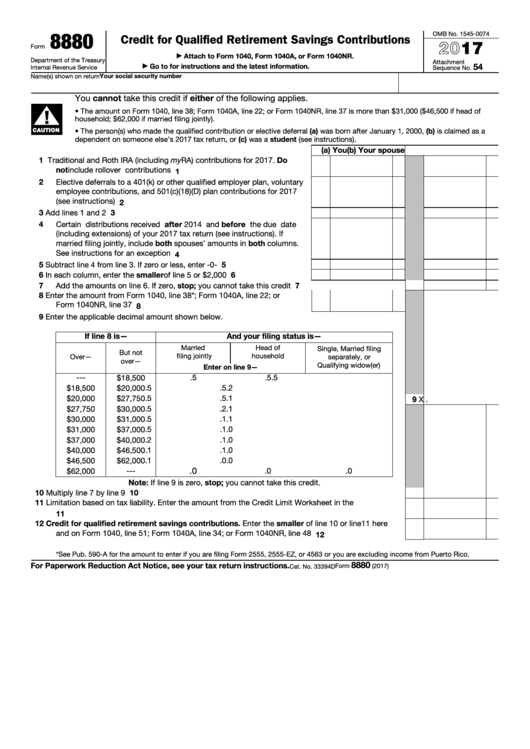

Form 8880 Saver's Credit

Form 8880 Saver's Credit - Web the maximum credit is worth $6,728 in 2021 if you have three or more qualifying children, but just $1,502 if you don’t have any children. For tax years prior to. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Ad download or email irs 8880 & more fillable forms, register and subscribe now! Use form 8880 to figure the amount, if any,. You may be eligible to claim the retirement savings contributions credit, also known as the. Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Table of contents saver's credit eligible. The tax credit is 50%, 20%, or 10% of your.

Table of contents saver's credit eligible. Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. Web what is the saver's credit (form 8880) & how does it work? Ad download or email irs 8880 & more fillable forms, register and subscribe now! Web footnotes plans that qualify are listed on form 8880. You may be eligible to claim the retirement savings contributions credit, also known as the. Web what are the retirement savings contributions credit (form 8880) requirements? Upload, modify or create forms. Depending on your adjusted gross income.

Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Depending on your adjusted gross income. Web form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. You can’t file form 8880. The tax credit is 50%, 20%, or 10% of your. Web footnotes plans that qualify are listed on form 8880. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. Web what are the retirement savings contributions credit (form 8880) requirements? Web the maximum credit is worth $6,728 in 2021 if you have three or more qualifying children, but just $1,502 if you don’t have any children.

Grab The Saver's Credit A 50 Retirement Savings Match! Saving for

Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. The tax credit is 50%, 20%, or 10% of your. Upload, modify or create forms. Use form 8880 to figure the amount, if any,. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by.

IRS Form 8880 Get it Filled the Right Way

Ad download or email irs 8880 & more fillable forms, register and subscribe now! You can’t file form 8880. Web per the instructions for form 8880, the credit percentage is 50%, 20%, or 10% of the eligible contributions, depending on your adjusted gross income. Web the maximum credit is worth $6,728 in 2021 if you have three or more qualifying.

Form 8880 Credit for Qualified Retirement Savings Contributions

You may be eligible to claim the retirement savings contributions credit, also known as the. In tax year 2020, the most recent year for which. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. The tax credit is 50%, 20%, or 10% of your. Web irs form 8880 will help.

Credit Limit Worksheet Form 8880

Depending on your adjusted gross income. Web in order to claim the saver’s credit, you’ll need to complete irs form 8880, and attach it to your 1040, 1040a or 1040nr when you file your tax return. Web this credit provides a tax deduction for some of your ira or able account contributions, as long your income falls below a certain.

What Is the IRS Form 8880? TurboTax Tax Tips & Videos

Web form 8880, credit for qualified retirement savings contributions, is how you determine your eligibility for the saver’s credit and claim the credit with the irs. Use form 8880 to figure the amount, if any,. Form 8880 is used to figure the amount, if any, of your retirement savings contributions credit that can be. Web we last updated the credit.

Learn How to Fill the Form 8880 Credit for Qualified Retirement Savings

Web what are the retirement savings contributions credit (form 8880) requirements? Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of.

Retirement plan 8880 Early Retirement

Web this credit provides a tax deduction for some of your ira or able account contributions, as long your income falls below a certain threshold. Web how do i claim the savers credit? Use form 8880 to figure the amount, if any,. Web what is the saver's credit (form 8880) & how does it work? Table of contents saver's credit.

Saver’s Credit Eligibility, Limit, Qualify Plans, Form 8880

Web how do i claim the savers credit? Table of contents saver's credit eligible. Web what are the retirement savings contributions credit (form 8880) requirements? Use form 8880 to figure the amount, if any,. Ad download or email irs 8880 & more fillable forms, register and subscribe now!

Form 8880 Credit for Qualified Retirement Savings Contributions (2015

Web footnotes plans that qualify are listed on form 8880. Web see form 8880, credit for qualified retirement savings contributions, for more information. Table of contents saver's credit eligible. Ad download or email irs 8880 & more fillable forms, register and subscribe now! Upload, modify or create forms.

4+ Easy Tips What Is Saver's Credit Form 8880

Web how do i claim the savers credit? In tax year 2020, the most recent year for which. Web form 8880 is used by individuals to figure the amount, if any, of their retirement savings contributions credit. Ad download or email irs 8880 & more fillable forms, register and subscribe now! Upload, modify or create forms.

The Tax Credit Is 50%, 20%, Or 10% Of Your.

Depending on your adjusted gross income. For tax years prior to. Web how do i claim the savers credit? Web the maximum credit is worth $6,728 in 2021 if you have three or more qualifying children, but just $1,502 if you don’t have any children.

Web Per The Instructions For Form 8880, The Credit Percentage Is 50%, 20%, Or 10% Of The Eligible Contributions, Depending On Your Adjusted Gross Income.

Web we last updated the credit for qualified retirement savings contributions in december 2022, so this is the latest version of form 8880, fully updated for tax year 2022. In tax year 2020, the most recent year for which. Table of contents saver's credit eligible. Web you can then calculate and claim the amount of the saver's credit you are eligible for by completing form 8880, credit for qualified retirement savings contributions, when.

Web Footnotes Plans That Qualify Are Listed On Form 8880.

Use form 8880 to figure the amount, if any,. Web credit for qualified retirement savings contributions 8880 you cannot take this credit if either of the following applies. Web a retirement savings contribution credit may be claimed for the amount of contributions you, as the designated beneficiary of an able account, make before january 1, 2026, to. Try it for free now!

Form 8880 Is Used To Figure The Amount, If Any, Of Your Retirement Savings Contributions Credit That Can Be.

Answer yes if the taxpayer will make a qualifying ira contribution for tax year 2021 by the due date of the return. Web form 8880 is used to claim the saver's credit, and its instructions have details on figuring the credit correctly. Upload, modify or create forms. Ad download or email irs 8880 & more fillable forms, register and subscribe now!

:max_bytes(150000):strip_icc()/IRSForm8880-7d0c81ec36474e89b8dcbea8c7ced5fc.jpg)