Form 480.6 A

Form 480.6 A - Web puerto rico form 480.6c for dividends and taxes withheld within an ira i have a traditional ira account with investments in numerous stocks and reits. Web efile 480.6a now why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation. If ordering a partial set in usb or sample usb, indicate Every person required to deduct and withhold any tax under section 1062.03 of the. Web filing the quarterly return for tax withheld and extension of 2019 first quarter to july 31. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web se requerirá la preparación de un formulario 480.6sp para informar todos los pagos por servicios prestados que estuvieron sujetos y no sujetos a retención durante el. Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. If you receive these forms, it is. Web there are variations of this form:

Every person required to deduct and withhold any tax under section 1062.03 of the. Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. Web puerto rico form 480.6c for dividends and taxes withheld within an ira i have a traditional ira account with investments in numerous stocks and reits. In the case of int erests, form 480.6a will be required. Web efile 480.6a now why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation. A copy of an exempt or political organization’s return, report, notice, or exemption application. Web for each form requested, complete either the paper or usb and enter the specific tax year(s), as indicated. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Books or records relating to a form or its instructions must be retained.

If ordering a partial set in usb or sample usb, indicate Every person required to deduct and withhold any tax under section 1062.03 of the. Web se requerirá la preparación de un formulario 480.6sp para informar todos los pagos por servicios prestados que estuvieron sujetos y no sujetos a retención durante el. A copy of an exempt or political organization’s return, report, notice, or exemption application. Web for each form requested, complete either the paper or usb and enter the specific tax year(s), as indicated. Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. Web form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Web filing the quarterly return for tax withheld and extension of 2019 first quarter to july 31. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. In the case of int erests, form 480.6a will be required.

480 7a 2018 Fill Online, Printable, Fillable, Blank PDFfiller

Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. Web there are variations of this form: Web filing the quarterly return for tax withheld and extension of 2019 first quarter to july 31. Every person required to deduct and withhold any tax under section 1062.03 of the. Web 16.

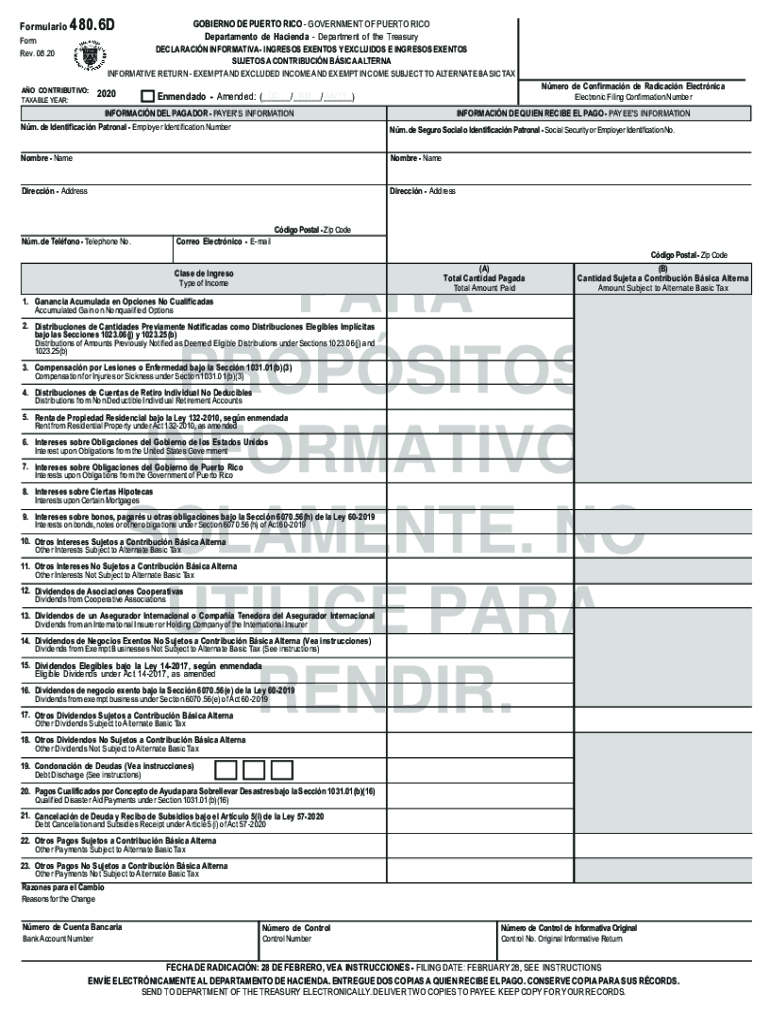

Form 480 6D Fill Out and Sign Printable PDF Template signNow

In the case of int erests, form 480.6a will be required. Web form that is subject to the paperwork reduction act unless the form displays a valid omb control number. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web there are variations of this form: Web forms.

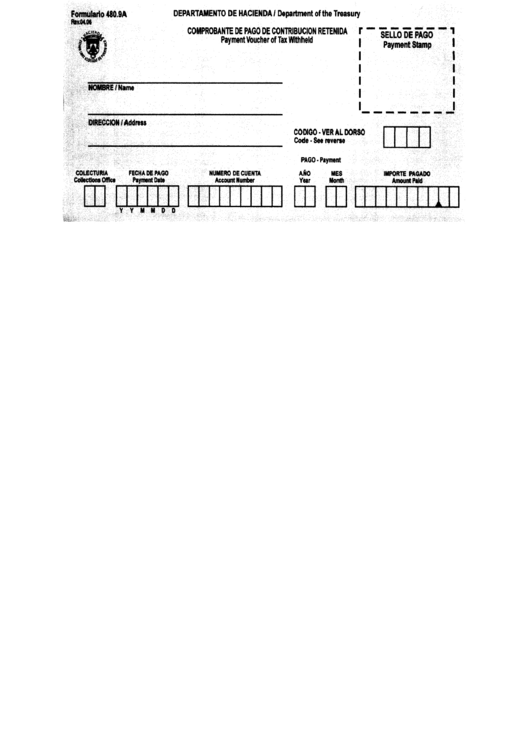

Form 480.9a Comprobanta De Pago De Contribucion Retendia (Payment

Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. In the case of int erests, form 480.6a will be required. Web efile 480.6a now why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation. Web forms 480.6a and.

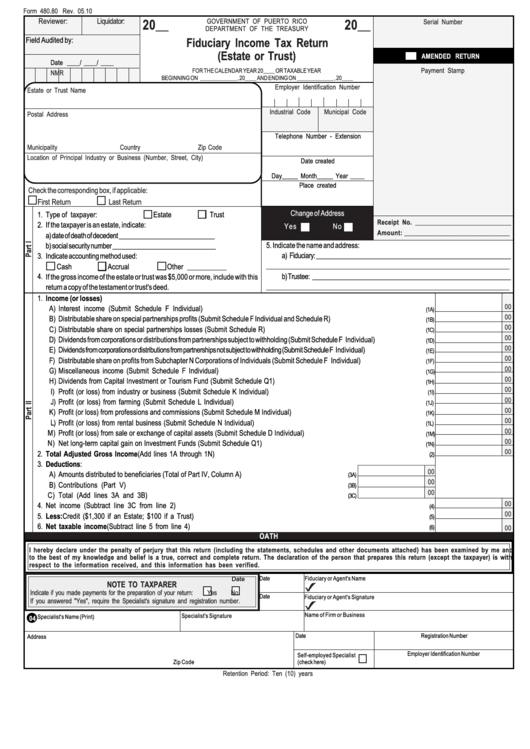

Form 480.80 Fiduciary Tax Return (Estate Or Trust) printable

Web se requerirá la preparación de un formulario 480.6sp para informar todos los pagos por servicios prestados que estuvieron sujetos y no sujetos a retención durante el. If ordering a partial set in usb or sample usb, indicate Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web.

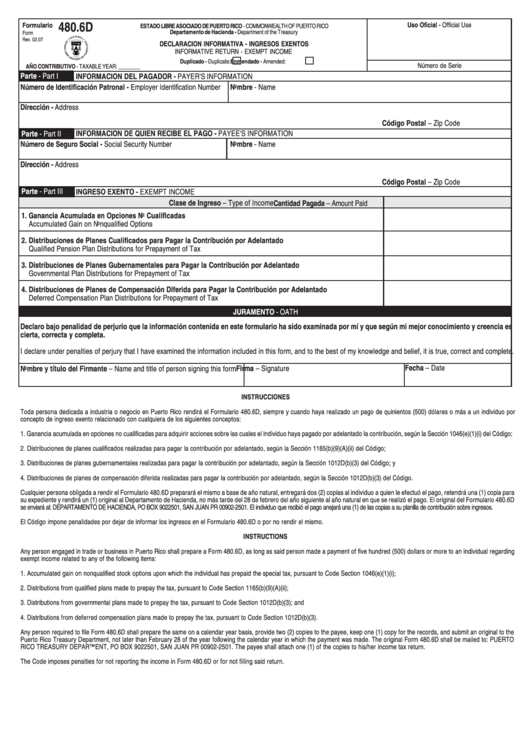

Form 480.6d Informative Return Exempt Puerto Rico

Web se requerirá la preparación de un formulario 480.6sp para informar todos los pagos por servicios prestados que estuvieron sujetos y no sujetos a retención durante el. In the case of int erests, form 480.6a will be required. A copy of an exempt or political organization’s return, report, notice, or exemption application. Every person required to deduct and withhold any.

PR 480.6D 2017 Fill out Tax Template Online US Legal Forms

Web puerto rico form 480.6c for dividends and taxes withheld within an ira i have a traditional ira account with investments in numerous stocks and reits. Books or records relating to a form or its instructions must be retained. Every person required to deduct and withhold any tax under section 1062.03 of the. If ordering a partial set in usb.

Form 480 Puerto Rico Fill Out and Sign Printable PDF Template signNow

If you receive these forms, it is. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web there are variations of this form: Web.

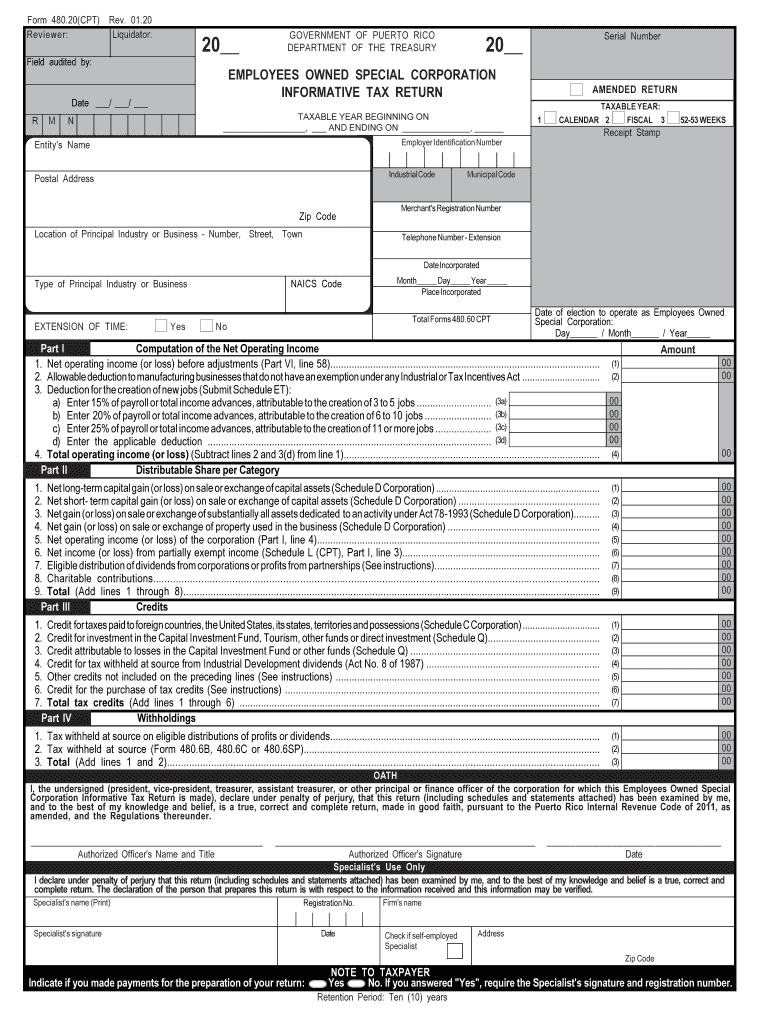

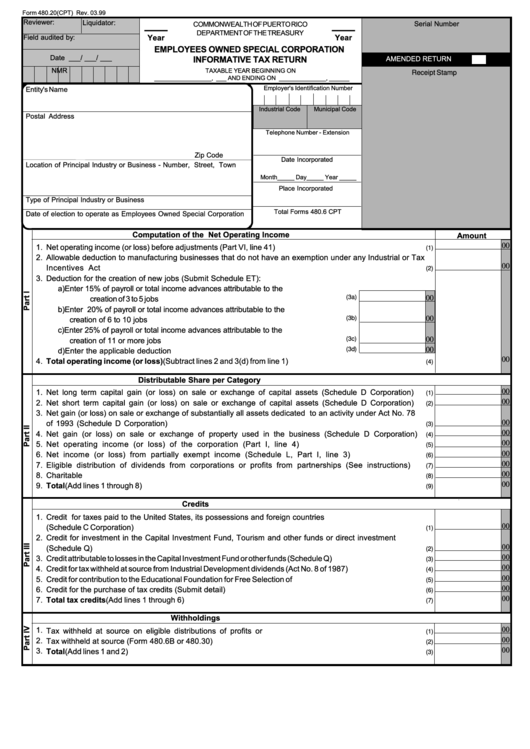

480 20 CPT Rev 01 20 480 20 CPT Rev 01 20 Fill Out and Sign Printable

Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web form that is subject to the paperwork reduction act unless the form displays a valid omb control number. If ordering a partial set in usb or sample usb, indicate Web se requerirá la preparación de un formulario 480.6sp.

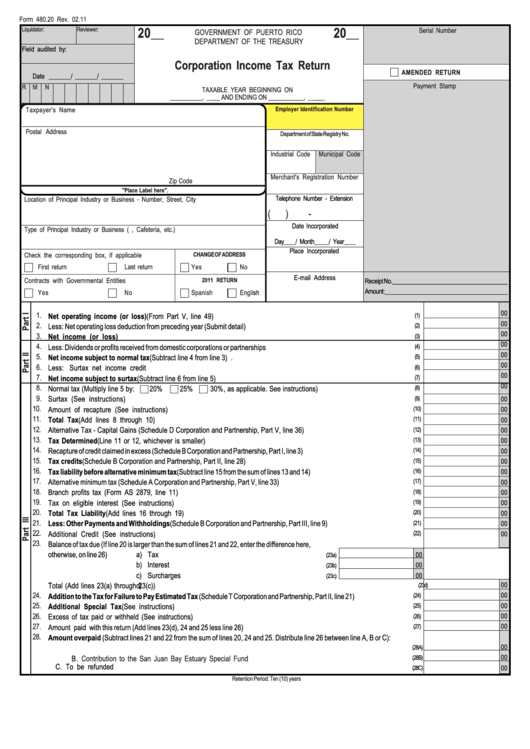

Form 480.20 Corporation Tax Return 2011 printable pdf download

Every person required to deduct and withhold any tax under section 1062.03 of the. Web there are variations of this form: Web 16 rows tax form (click on the link) form name. Web efile 480.6a now why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation. If ordering a.

Form 480.20(Cpt) Employees Owned Special Corporation Informative Tax

If you receive these forms, it is. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web form that is subject to the paperwork reduction act unless the form displays a valid omb control number. A copy of an exempt or political organization’s return, report,.

If Ordering A Partial Set In Usb Or Sample Usb, Indicate

A copy of an exempt or political organization’s return, report, notice, or exemption application. Web filing the quarterly return for tax withheld and extension of 2019 first quarter to july 31. Web se requerirá la preparación de un formulario 480.6sp para informar todos los pagos por servicios prestados que estuvieron sujetos y no sujetos a retención durante el. If you receive these forms, it is.

Web For Each Form Requested, Complete Either The Paper Or Usb And Enter The Specific Tax Year(S), As Indicated.

Books or records relating to a form or its instructions must be retained. Web 16 rows tax form (click on the link) form name. Web the preparation of form 480.6a will be required when the payment not subject to withholding is $500 or more. Web efile 480.6a now why efile with tax1099 easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation.

Web Series 480.6A Reports Any Taxable Dividends And/Or Gross Proceeds From Realized Capital Gains Or Losses In Your Taxable Investment Account.

In the case of int erests, form 480.6a will be required. Web puerto rico form 480.6c for dividends and taxes withheld within an ira i have a traditional ira account with investments in numerous stocks and reits. Web there are variations of this form: Web form that is subject to the paperwork reduction act unless the form displays a valid omb control number.

Every Person Required To Deduct And Withhold Any Tax Under Section 1062.03 Of The.

Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer.